Emerging innovations such as artificial intelligence (AI), machine learning, and blockchain are driving a transformation in risk and compliance oversight. According to Deloitte, more than 75% of surveyed financial enterprises are currently implementing or planning to adopt AI-enhanced regulatory processes within the next three years. Data validates that companies at the forefront of implementing these advanced systems achieve enhanced efficiency, reduced risk incidents, and more streamlined regulatory workflows.

In 2017 alone, early AI adopters saw 41% faster compliance procedure response times over lagging competitors according to McKinsey. In this blog, we will examine the essential ways in which cutting-edge technology is impacting risk and compliance operations, analyze current adoption trends, and predict future developments. As automation and self-learning capabilities mature, they will become more widespread across industries as organizations acknowledge the measurable benefits of incorporating innovation into traditionally manual reporting processes.

Table of Contents

Emerging Technologies Transform AI in Risk Management

Advanced technologies like artificial intelligence (AI), robotic process automation, and blockchain enable big changes in risk management. A study shows the transformative potential of AI is set to revolutionize various roles, elevating performance across different functions. Top companies already use AI tools for automated assessments, predictive analytics, and data-based decisions about threats.

For example, HSBC uses AI to screen transactions for signs of illegal activity. This led to 50% fewer false alarms. It let analysts concentrate on higher-risk cases. Starbucks applies AI to spot red flags in sales data that may show fraud. These smart systems boosted loss prevention 30%.

As leading-edge tech enters risk management, teams get superior data abilities, efficiency gains, and lower business threats. They move from reactive to proactive methods. Analysts go from documenting past issues to simulating future scenarios with AI models. Automated handling of routine tasks allows risk managers more time to focus on strategic planning.

Automation Drives Efficiency in Compliance

Regulatory compliance processes have historically depended on manual work leading to inefficiency and high costs. Now, robotic process automation (RPA) and smart workflows are enabling automation to ease the burden of compliance.

Over 50 percent of financial companies report a 40 percent improvement in compliance efficiency after deploying these new technologies. This has freed up thousands of hours that human employees previously spent on routine tasks.

For example, Deutsche Bank automated anti-money laundering (AML) screening and know your customer (KYC) reviews by developing a centralized system combining RPA, artificial intelligence, and data analytics. This delivered efficiency gains of 50 percent in some compliance areas.

UBS also automated over 150 regular compliance reports through an AI assistant, reducing the time to generate these reports from hours to minutes. This highlights how embracing a comprehensive risk and compliance management solution empowers organizations to concentrate on strategic initiatives, allowing automation to tackle mundane tasks. The result is an overall improvement in productivity and coverage within the realm of compliance.

Data Analytics Revolutionizes Risk Assessment

The use of big data analytics and advanced artificial intelligence is dramatically changing how companies identify and evaluate risks. Studies have shown that companies using these new technologies for risk management have experienced a 20-30 percent decrease in problems related to operations risks.

Several leading banks employ machine learning software to extract valuable insights from millions of data points related to loans, trades, payments, and other areas. This gives the banks a comprehensive perspective on the total risk exposure in different product lines, geographic regions, and risk categories. Citigroup implemented these analytical models to substantially improve their ability to detect risks.

Financial technology startups also utilize alternative data sources such as social media, website traffic, and satellite data to generate risk assessments for small business loans. Through the expansion of data inputs, these companies can enhance their ability to predict the likelihood of default or fraud compared to traditional credit scores.

With the continued growth of analytics and data usage, risk management is evolving to become more proactive, emphasizing the prevention of problems before they arise.

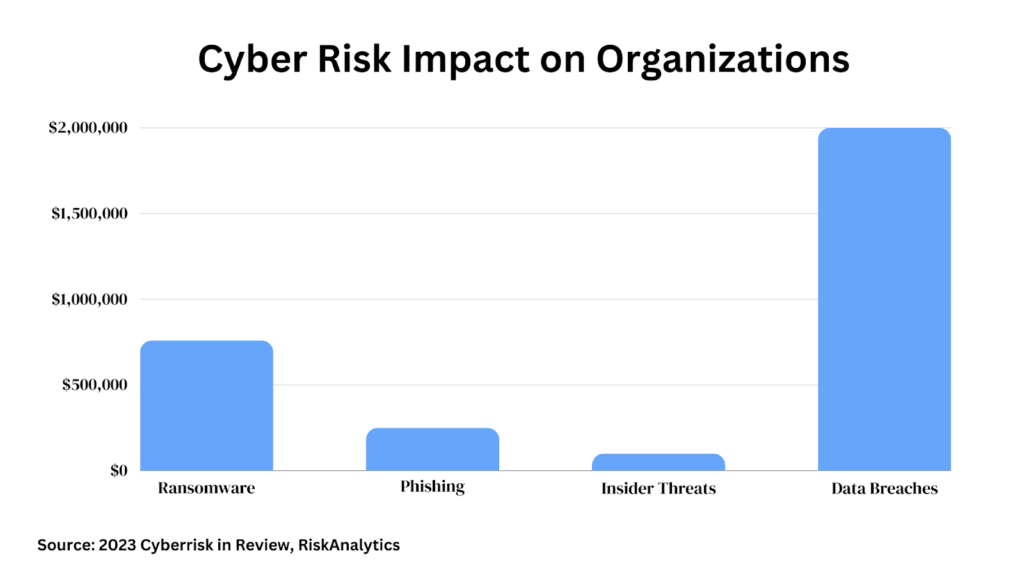

Cybersecurity Fortifies Risk Management

As digital channels continue to grow at an exponential pace, cyber risks represent one of the biggest dangers that all companies must address. High-profile cyber attacks show that a security breach can lead to massive financial losses and reputation damage. As a result, investing in robust cybersecurity protections has become essential, with leading enterprises reporting a 48 percent decrease in data breaches after implementation.

Organizations are using cyber artificial intelligence to model attack simulations, predict vulnerabilities, and take corrective actions. Cyber data analytics provides real-time visibility into networks, detecting anomalies and suspicious behaviors. Technologies like biometrics, encryption, blockchain, and cloud access security brokers offer robust protection.

As cyber risks continue to accelerate, such integrated security measures boost resilience while securing sensitive organizational data and systems. With proper cybersecurity investments and vigilant monitoring, companies can substantially reduce their exposure to cyberattacks even as the threat environment grows ever more complex.

RegTech Automates Regulatory Processes

Regulatory technology (RegTech) refers to advanced software solutions specifically designed to address compliance and regulatory challenges. With increasing government rules and oversight across banking, financial services, healthcare, and other industries, adopting RegTech tools leads to a 40-60 percent decrease in compliance costs according to leading estimates.

RegTech applications enable automated reporting, transaction monitoring, identity verification, regulatory filings and more – all customized to relevant laws like anti-money laundering (AML), know your customer (KYC), Basel III capital rules, and SEC regulations. Insurance providers use RegTech for real-time analytics of solvency risks. Banks deploy RegTech to accelerate customer onboarding while remaining compliant.

As regulations continue to grow more complex across sectors, RegTech systems allow organizations to scale governance processes efficiently while ensuring adherence to the latest mandates. By leveraging RegTech, companies can transform compliance from a cost center to a source of strategic advantage.

Cultural Change Enables Technology Adoption

Having the right organizational culture is vital for the successful adoption of emerging technologies for risk management.

Experts suggest organizing educational programs on artificial intelligence, advanced analytics, and cybersecurity for risk and compliance teams to promote learning. Appointing analytics and technology evangelists also boosts adoption by getting more employees enthusiastic about new tools. Starting with small proof of concepts then scaling to enterprise-wide systems ensures smoother transitions.

Above all, focusing on augmented intelligence where technology enhances human capabilities – not replaces them – is crucial for changing mindsets around tech adoption. This means using AI and data analytics to give employees better insights and productivity rather than automation that reduces headcount.

Firms that cultivate a collaborative, innovative culture realize the most benefits from new technologies by uniting exceptional human skills with data-driven machine intelligence. With a supportive culture focused on augmentation over automation, risk teams can fully leverage advanced tools to transform legacy processes.

The Future: Predictive Risk Analytics

As data analytics models become more advanced, risk management will shift more towards predictive simulations rather than reactive responses after problems emerge.

Cutting-edge machine learning techniques now enable running millions of simulated scenarios to foresee emerging risks and potential outliers. This is transformational for preemptively mitigating risks before they translate into real losses.

We will see predictive models leveraged across operational risks, portfolio exposures, credit risks, fraud patterns, cyber threats, regulatory changes, and more. Proactive data analytics will become a standard practice for risk management teams across various sectors.

While these technologies will continue rapidly evolving, thoughtfully integrating them into organizational workflows ensures risk and compliance groups remain prepared for the future. With robust data pipelines and advanced analytics, they can get ahead of risks rather than just reacting.

The next generation of risk management will involve humans and machines working together – with predictive intelligence allowing risks to be addressed even before materializing. The combination of expert human judgment with sophisticated quantitative simulations fosters a highly risk-aware organizational culture.

Final Thoughts

Emerging technologies such as artificial intelligence, machine learning, and advanced analytics are reshaping the landscape of risk management and regulatory compliance. By processing massive datasets and uncovering hidden insights humans may overlook, these tools enable smarter, predictive risk models rather than reactive approaches. However, subjective human perspectives remain vital, making An augmented model that combines human nuance with technological capabilities is ideal.

While adoption may encounter challenges such as legacy systems and skill gaps, targeted training and cultural change can facilitate integration. With a robust data infrastructure, effective governance, and visionary leadership, financial institutions can harness the power of regulatory technology and analytics to revolutionize risk management, turning compliance from a cost center into a competitive advantage.

FAQs

- How is AI shaping the future of risk management?

AI is making risk management more intelligent and proactive. AI tools analyze big data to detect emerging risk patterns, run predictive simulations, and recommend mitigation actions. This allows companies to get ahead of potential threats before they occur. Compliance processes also gain efficiency boosts from intelligent automation, deep learning, and natural language processing.

- What are the main obstacles to adopting new technologies for compliance?

Legacy IT systems, scarce technical skills, cultural resistance, and lack of executive sponsorship are key barriers to technology adoption initiatives face. Firms must invest in integration tools, training programs, and pilots to demonstrate value. Appointing analytics champions and gradually scaling adoption can facilitate the cultural shift.

- Can technology completely replace human judgment in risk evaluations?

While advanced algorithms can process more data and uncover obscure correlations that humans may miss, subjective business environment nuances and emerging socio-political contexts also influence risks. An augmented approach combining human insights with technology therefore remains ideal, rather than the wholesale replacement of people with machines.

socialhead

socialhead